In the evolving landscape of global finance, diversified investment strategies have become increasingly vital for ensuring both growth and risk mitigation. Investment clubs, which pool resources and expertise to explore opportunities across multiple sectors, have garnered significant attention for their ability to navigate this complex terrain. The G25 SCP Club Côte d'Ivoire, a prominent player in the investment community, exemplifies this approach with its keen focus on the strategic sectors of agriculture, real estate, stock markets, and gold mining within West Africa. This week, the club is specifically turning its attention to these areas in Côte d'Ivoire and broader West Africa, where opportunities abound amid an evolving economic environment. This article provides an analytical perspective on the economic trends within these sectors, offering insight into the strategic decisions of the G25 SCP Club and the prospects of these investment avenues.

Agricultural Opportunities in West Africa

Agriculture remains one of the most vital sectors in West Africa, with its expansive arable land, favorable climate, and rich biodiversity offering significant potential for growth. Côte d'Ivoire, in particular, has solidified its position as one of the world's leading producers of cocoa, coffee, and palm oil. This year, the G25 SCP Club is focusing on the transformation of agriculture through the adoption of modern farming techniques, such as precision agriculture, biotechnology, and sustainable farming practices. With a rising global demand for organic and sustainably produced commodities, West African agriculture is on the cusp of a significant transformation.

The ongoing efforts to improve infrastructure, including transportation networks and irrigation systems, are further enhancing the attractiveness of agricultural investments in the region. Additionally, regional governments, particularly in Côte d'Ivoire, have been introducing favorable policies such as tax breaks, subsidies, and public-private partnerships to encourage agricultural ventures. The G25 SCP Club aims to capitalize on these trends by directing investments into crop production, agribusiness, and value-added processing industries. The focus on agricultural exports, including cocoa, will benefit from growing demand in international markets, offering lucrative returns for early investors who recognize the potential of the sector.

Real Estate Sector: Growth and Urbanization

The real estate market in Côte d'Ivoire and West Africa at large has experienced significant growth in recent years, driven by rapid urbanization, a rising middle class, and increasing foreign direct investment (FDI). Cities like Abidjan, the economic capital of Côte d'Ivoire, have become vibrant hubs of commercial and residential development. The G25 SCP Club sees this trend as an opportunity to invest in both commercial and residential real estate, particularly in growing urban centers where demand for modern housing and infrastructure continues to rise.

Real estate in Côte d'Ivoire is experiencing a shift toward high-end residential developments, mixed-use commercial properties, and the expansion of industrial real estate due to increased demand for logistics and warehousing facilities. With a robust infrastructure development plan under the Ivorian government’s National Development Plan (2016–2020), including improvements in transportation and energy, the sector is poised for continued growth. Real estate investments offer the club a stable income stream through rental properties, as well as capital appreciation from value increases over time. The club is keen to explore opportunities in residential housing, office spaces, and retail centers, as well as emerging markets within the real estate sector.

Stock Market: The BRVM and Investment Opportunities

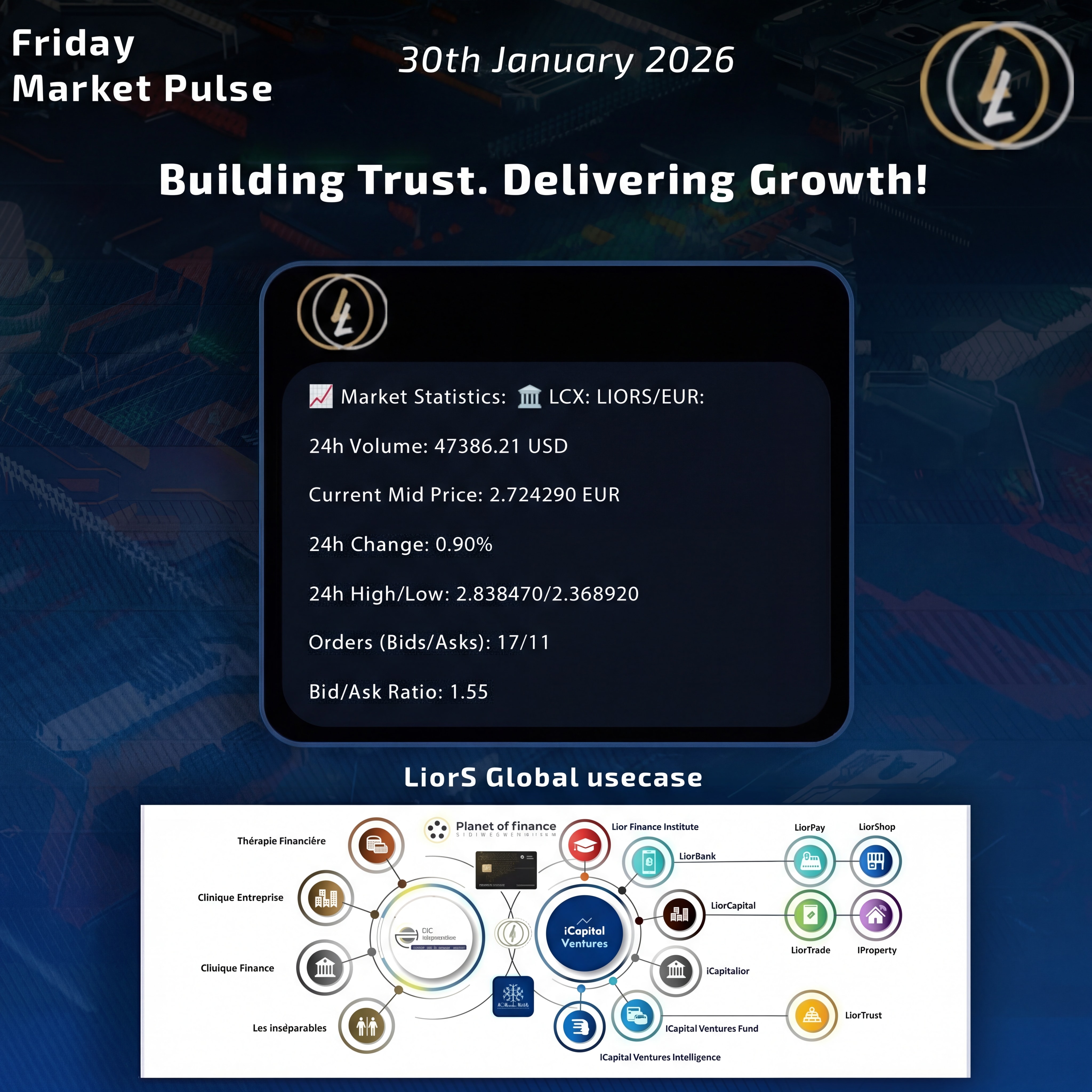

The West African regional stock exchange, the BRVM (Bourse Régionale des Valeurs Mobilières), headquartered in Abidjan, presents a compelling investment avenue for the G25 SCP Club. The BRVM serves as the central stock exchange for eight West African countries, including Côte d'Ivoire, and has been a focal point for capital market development in the region. In recent years, the BRVM has shown steady growth, driven by increasing market capitalization, improved liquidity, and a larger pool of listed companies.

The G25 SCP Club is exploring opportunities in this growing stock market, particularly in sectors such as banking, telecommunications, and consumer goods. As the regional economy becomes more integrated and companies continue to expand their operations across borders, the stock market offers ample potential for both short-term and long-term gains. Moreover, the government’s commitment to improving the business environment and regulatory frameworks is enhancing investor confidence in the BRVM. The club is strategically positioning itself to benefit from this upward trajectory by selecting well-established, high-performing companies with strong fundamentals and a clear path for growth.

Gold Mining: An Established yet Expanding Industry

West Africa, including Côte d'Ivoire, is known for its rich mineral resources, with gold being one of the region's most valuable assets. Côte d'Ivoire is one of the fastest-growing gold producers in Africa, with increasing exploration and mining activity in recent years. The global demand for gold, driven by its role as a safe haven asset and its use in technology, jewelry, and finance, continues to make gold mining a lucrative investment avenue.

The G25 SCP Club is particularly interested in investing in gold mining, capitalizing on both exploration and production opportunities. The club is assessing several mining projects, focusing on those with strong management teams, sustainable practices, and solid growth potential. The increasing demand for gold, alongside favorable international prices, positions this sector as a key driver of economic growth in the region. Moreover, with rising global inflation concerns and market volatility, gold’s role as a hedge against economic instability is further solidifying its appeal to investors.

The G25 SCP Club Côte d'Ivoire’s diversified focus on agriculture, real estate, the BRVM stock market, and gold mining reflects a sophisticated approach to capturing growth opportunities in West Africa. By analyzing the economic trends within each of these sectors, the club is able to navigate the complexities of the regional market while positioning itself for long-term success. Agricultural opportunities are vast, driven by modernizing farming techniques and growing global demand, while real estate development remains a solid investment due to rapid urbanization and infrastructure improvements. The BRVM stock exchange offers an expanding platform for investors looking for exposure to regional growth, and gold mining remains a highly attractive investment given the region’s rich mineral resources and global demand for the precious metal.

In the broader context of West Africa’s economic transformation, the G25 SCP Club’s diversified investment strategy positions it to capitalize on the region's rise as a key global player. By strategically focusing on these sectors, the club not only seeks to maximize financial returns but also contribute to the sustainable economic growth of Côte d'Ivoire and West Africa at large. As these sectors continue to develop, the club’s investments will likely play a pivotal role in shaping the future of the region’s economy, solidifying its position as a forward-thinking and influential investment entity.

Share

00 Comments

No Comments found!